Smarter Budgets: How Business Intelligence Software Revolutionizes Financial Planning

In today’s fast-paced business environment, effective financial planning is no longer a luxury—it’s a necessity. Companies are constantly seeking ways to optimize resources, make data-driven decisions, and gain a competitive edge. This is where business intelligence (BI) software steps in, offering a powerful solution for creating smarter budgets and achieving superior financial outcomes. The traditional methods of budgeting, often reliant on spreadsheets and manual data entry, are proving increasingly inadequate. They are time-consuming, prone to errors, and lack the agility needed to respond to rapidly changing market conditions. Business intelligence software addresses these shortcomings by providing real-time insights, automated reporting, and sophisticated analytical capabilities.

This article will explore how business intelligence software empowers businesses to create smarter budgets. We’ll delve into the specific benefits, features, and real-world applications that make BI a game-changer for financial planning. From improved accuracy and forecasting to enhanced decision-making and cost optimization, we will cover it all. Understanding the role of this technology is crucial for any organization aiming to thrive in the modern business landscape.

The Limitations of Traditional Budgeting Methods

Before exploring the advantages of business intelligence software, it’s essential to understand the limitations of traditional budgeting methods. These methods often involve manual data collection, consolidation, and analysis, which can be incredibly time-consuming and resource-intensive.

- Time-Consuming Process: Traditional budgeting relies heavily on spreadsheets and manual data entry. This can take weeks or even months.

- Error-Prone: Manual data entry and complex formulas in spreadsheets are prone to human error. This can lead to inaccurate budgets.

- Lack of Real-Time Insights: Traditional budgets are often based on historical data. This makes it difficult to respond to current market changes.

- Limited Forecasting Capabilities: Traditional methods often lack the advanced forecasting capabilities. This can make it difficult to predict future financial performance.

- Difficult Collaboration: Sharing and collaborating on spreadsheets can be challenging. This can hinder communication and decision-making.

These limitations can significantly hinder a company’s ability to make informed decisions, optimize resources, and respond effectively to changing market conditions. Business intelligence software overcomes these challenges by automating processes, providing real-time insights, and offering advanced analytical capabilities.

How Business Intelligence Software Creates Smarter Budgets

Business intelligence software transforms the budgeting process by automating tasks, providing real-time data, and offering advanced analytical capabilities. This leads to more accurate, efficient, and insightful budgeting practices. Here’s how:

- Automated Data Integration: BI software can automatically integrate data from various sources. This includes accounting systems, CRM systems, and other relevant databases.

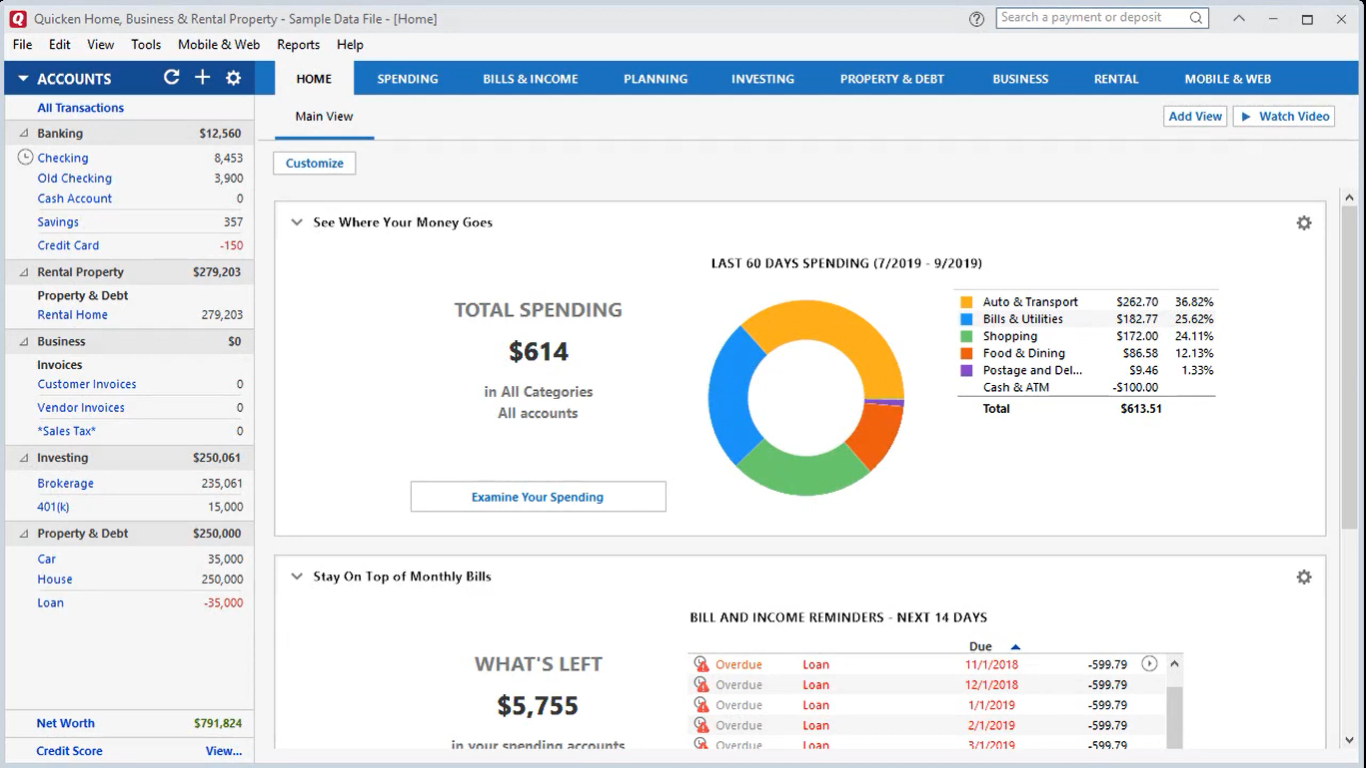

- Real-Time Data Visualization: BI tools offer interactive dashboards and reports. This allows users to visualize financial data and identify trends quickly.

- Advanced Analytics: BI software provides advanced analytics capabilities. This includes forecasting, trend analysis, and scenario planning.

- Improved Accuracy: Automation reduces the risk of human error. This leads to more accurate budgets.

- Enhanced Collaboration: BI platforms often facilitate collaboration. This allows different teams to work together on the budgeting process.

By leveraging these features, businesses can create smarter budgets. They can make better decisions and achieve their financial goals more effectively.

Key Features of Business Intelligence Software for Budgeting

Several key features make business intelligence software an invaluable tool for budgeting. These features contribute to more accurate, efficient, and insightful financial planning. Understanding these features is crucial for selecting the right BI solution.

- Data Integration and Consolidation: The ability to connect to multiple data sources and consolidate data is crucial. This provides a unified view of financial information.

- Data Visualization and Dashboards: Interactive dashboards and reports provide real-time insights. This allows users to quickly identify trends and anomalies.

- Forecasting and Predictive Analytics: Advanced forecasting models can predict future financial performance. This allows for proactive planning.

- Reporting and Analysis: Customizable reports and analysis tools enable in-depth financial analysis. This leads to better decision-making.

- Collaboration and Sharing: Features that facilitate collaboration improve team communication. This streamlines the budgeting process.

- Alerts and Notifications: Automated alerts notify users of key performance indicators. This helps to identify and address potential issues.

These features work together to provide a comprehensive solution for creating smarter budgets. They empower businesses to make data-driven decisions and achieve their financial goals.

Benefits of Smarter Budgets with Business Intelligence

Implementing business intelligence software for budgeting yields numerous benefits. These benefits contribute to improved financial performance, better decision-making, and enhanced operational efficiency. The advantages are clear.

- Improved Accuracy and Reliability: Automation and real-time data reduce errors. This leads to more accurate budgets.

- Enhanced Forecasting Capabilities: Advanced analytics enable better predictions of future financial performance. This allows for proactive planning.

- Faster Decision-Making: Real-time insights and interactive dashboards allow for quicker decision-making. This improves responsiveness.

- Cost Optimization: Better visibility into financial data helps identify areas for cost reduction. This improves profitability.

- Increased Efficiency: Automation streamlines the budgeting process. This frees up time for strategic initiatives.

- Better Resource Allocation: Data-driven insights help allocate resources more effectively. This maximizes return on investment.

- Enhanced Collaboration and Communication: Improved communication improves teamwork. This streamlines the budgeting process.

These benefits collectively contribute to a more robust and effective financial planning process. This helps businesses achieve their financial objectives.

Real-World Applications and Case Studies

The impact of business intelligence software on budgeting is evident in various real-world applications. Several businesses across different industries have successfully implemented BI solutions. They have achieved significant improvements in their financial planning processes. Consider these examples:

- Retail Industry: A large retail chain used BI to analyze sales data. They optimized inventory management and reduced costs.

- Healthcare Sector: A healthcare provider used BI to track patient revenue and expenses. They improved financial forecasting.

- Manufacturing Company: A manufacturing company used BI to monitor production costs. They identified areas for efficiency gains.

- Financial Services: A financial services firm used BI to analyze customer data. They improved customer relationship management.

These case studies demonstrate the versatility and effectiveness of business intelligence software. They show its ability to improve financial outcomes across various industries.

Choosing the Right Business Intelligence Software

Selecting the right business intelligence software is crucial for achieving the desired results. Several factors should be considered when evaluating BI solutions. These factors include the specific needs of the business and the capabilities of the software.

- Data Integration Capabilities: Ensure the software can integrate with existing data sources. This is essential for a unified view.

- User-Friendly Interface: The software should have an intuitive interface. This makes it easy for users to navigate and analyze data.

- Reporting and Analytics Features: The software should offer robust reporting and analysis capabilities. This is vital for in-depth financial analysis.

- Scalability and Flexibility: The software should be able to scale with the business. It should also adapt to evolving needs.

- Cost and Implementation: Consider the total cost of ownership. This includes the software cost, implementation, and ongoing maintenance.

- Vendor Support and Training: Assess the vendor’s support and training options. This can ensure successful implementation and use.

Choosing the right software will ensure a smooth implementation. It will also maximize the benefits of smarter budgets.

Implementing Business Intelligence for Smarter Budgets: A Step-by-Step Guide

Implementing business intelligence software for budgeting requires a structured approach. This guide outlines the key steps involved in the implementation process. Following these steps will help ensure a successful deployment.

- Assess Needs and Goals: Define specific budgeting goals. Identify the key performance indicators (KPIs).

- Select and Implement Software: Choose the appropriate BI software. Implement the software across the organization.

- Integrate Data Sources: Connect the software to all relevant data sources. This includes accounting systems and CRM systems.

- Train Users: Provide training to all users. This helps them understand the software.

- Develop Dashboards and Reports: Create customized dashboards. Design reports to meet specific needs.

- Monitor and Analyze Data: Regularly monitor financial data. Analyze trends and identify areas for improvement.

- Refine and Optimize: Continuously refine the budgeting process. Optimize the use of the BI software.

Following these steps will help ensure a successful implementation. It will also help businesses create smarter budgets.

The Future of Budgeting with Business Intelligence

The future of budgeting is inextricably linked with business intelligence software. As technology continues to evolve, BI will become even more sophisticated. This will further transform the way businesses approach financial planning. Key trends include:

- Artificial Intelligence (AI) and Machine Learning (ML): AI and ML will automate tasks. They will improve forecasting and analysis.

- Cloud-Based BI Solutions: Cloud-based BI solutions will become more prevalent. This will improve accessibility and scalability.

- Real-Time Data Integration: Real-time data integration will become more seamless. This will provide immediate insights.

- Enhanced User Experience: BI platforms will offer more intuitive interfaces. This will improve usability.

- Increased Automation: Automation will become more extensive. This will streamline the budgeting process.

These trends suggest a future where budgeting is more automated, insightful, and efficient. This will enable businesses to make better decisions. They will also achieve their financial goals more effectively.

Conclusion: Embracing Smarter Budgets for Financial Success

Business intelligence software is no longer a luxury. It is a necessity for creating smarter budgets. It is also crucial for achieving financial success in today’s competitive landscape. By embracing BI, businesses can overcome the limitations of traditional budgeting methods. They can also unlock the power of data-driven decision-making. From automated data integration and real-time insights to advanced analytics and improved collaboration, BI offers a comprehensive solution. It empowers organizations to make more informed decisions, optimize resources, and achieve their financial objectives. The future of budgeting is undoubtedly intertwined with the continued evolution of business intelligence software. Those who embrace this technology will be best positioned to thrive in the years to come. They will create smarter budgets and achieve sustained financial success. [See also: Choosing the Right BI Software for Your Business]